How the New EU ESG Reporting Rules Will Affect E-Commerce Brands

A couple of weeks ago, I had a chat with entrepreneur and sustainability consultant Robin Boustead.

As the director of ESG Report Pro and author of the soon-to-be-published ESG Reporting Manual, Robin certainly has a wealth of knowledge regarding ESG reporting standards.

With all the new rules surrounding ESG reporting in Europe and worldwide, I wanted to take some time to better understand the subject. For instance, how will the changing ESG tide affect our e-commerce retailer clients, and us by extension?

Taking advantage of Robin’s wealth of experience and knowledge in the ESG/sustainability arena, Chris Crutchley and I used the opportunity to ask Robin a few questions about the new reporting regulations, including

- What companies will be affected by the new regulations?

- When will they go into effect?

- How will these regulations affect the rest of the world?

Read on to find out what his answers were.

Read about CBIP's Adaptable 4PL Logistics Services

Small business requirements

Q1: What types of companies fall under the reporting regulations? Are SMEs included?

The CSRD( Corporate Sustainability Reporting Directive) is for companies with over 500 employees.

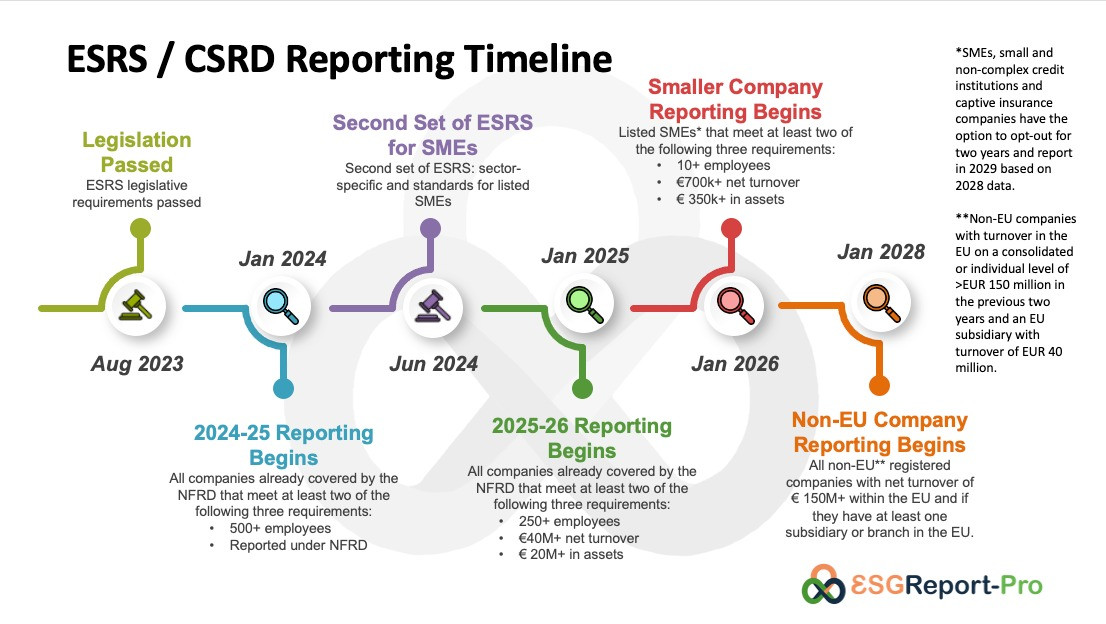

Those reporting requirements are already in effect in 2024, meaning those companies will need to submit reports in 2025. That 500-employee boundary will drop to 250 in 2025, and will likely drop again in 2028.

For the moment, SMEs do not need to submit their own reports. However, just because they do not need to submit a separate report, does not mean they will not be affected: They may well get caught in the value chains of larger companies.

Either way, it is making more and more business sense to disclose some due diligence, climate, and workforce information within a ‘responsible business report’… plus add in some CSR and establish a baseline year for transition planning.

Q2: What are the rules?

The rules include transition planning for climate and other impacts, plus they introduce a level of transparency meant to foster and highlight better business practices.

The idea of the rules is to put pressure on companies both directly and indirectly to perform more sustainably.

For details on CSRD and the regulations, check out this site.

Q3: Will all EU countries have the same reporting regulations? What about abroad?

All 28 EU States are covered by the CSRD and CSDDD.

Other countries around the world are integrating the ISSB’s IFRS (governance and climate disclosures), which will gradually expand to be similar to the CSRD.

Enforcement

Q4: What are the repercussions for failing to report under the new regulations?

Repercussions depend on the country, but punishment for wrongful reporting is no joke.

France has just passed a law to make wrongful ESG declarations a criminal offense, threatening jail time for company directors along with major fines — up to 10% of turnover and/or 50% of profits, depending on the case. It’s likely that other EU states will pass similar laws.

Global influence

Q5: How will these new regulations affect the rest of the world?

The new regulations are starting out targeting specific listed companies in the EU, but it’s all part of a global trend that is slowly taking hold. Everything is global: EU companies do business with Asian suppliers and logistics providers, and the Americas are already on their way, whether it may be slower or not getting there.

It will affect all businesses, everywhere, and in far more ways than most folks are currently thinking about. The idea behind the EU’s statutory ESG reporting is to create behavioral and systemic change across all sectors.